Both the development and take-up of industrial parks in Central Europe is continuing and slightly accelerating in comparison with last year, according to research from Cushman & Wakefield. The appetite for investing in commercial properties is also increasing, with a shortage on the supply side making buyers willing to pay more. This trend is most obvious for logistic and production facilities.

Cushman & Wakefield’s Central European Industrial Market Report covers Poland, Czech Republic, Hungary, Slovakia and Romania.

“The period of low interest rates has lasted a very long time. This restricts the range of investors’ opportunities for depositing and increasing their funds, and commercial properties present a good opportunity. The economy is growing, companies are expanding and e-commerce is developing. As a result, the demand for logistic and production properties is growing, in effect increasing their value”, says Ferdinand Hlobil, Head of Cushman & Wakefield’s CE Industrial Team.

The biggest transaction this year to date was CTP’s acquisition of parks from developers in Romania.

Differentiating positions – developers versus investors

The market in Central Europe is undergoing diversification. Players are gradually differentiating in terms of their market roles. Developers focus primarily on developing new projects. They include companies such as Goodman and Panattoni. The next group is companies that build parks and then retain their ownership or expand their portfolios by acquiring existing facilities. Examples include CTP, P3 and Prologis. The third group is investors who prefer acquiring completed parks to building them – one such company is Logicor; it bought parks in Poland and the Czech Republic this year.

Development and take-up conform to last year figures

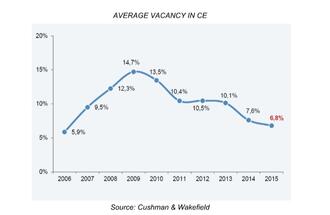

Companies leased more space than developers newly built in the first half of this year. As a result, the ratio of vacant space continues to decrease, averaging 6.8 per cent in Central Europe. This is the lowest figure in the last nine years (see graph below).

“The decrease is most prominent in Hungary where the vacancy rate decreased by two percentage points to the current 13.7 per cent within six months. If Hungary keeps this pace up, it could reach a healthy vacancy rate of about ten percent around the turn of the year”, Ferdinand Hlobil says.

More than 600,000 sq m of new stock was built in Central Europe in the first half of this year (versus 520,000 sq m in the same period last year). 2.1million sq m was leased (versus 1.9 million sq m last year). In total, there is 18.5 million sq m in the region at this point, with Poland approaching the ten million mark and the Czech Republic having reached five million square metres recently.

Outlook

Central Europe’s industrial market is strong and stable. The inflow of production and logistic companies from Germany continues, and we expect further expansion of e-commerce firms. This applies to both domestic players and e-shops coming from the West. Chinese and other Asian manufacturing companies will come as well, as proximity to automotive manufacturers is of strategic importance to them.

“Rents have been stable for almost ten years now. Where rents decrease, this is due to bulk discounts: manufacturing companies coming to the region rent significantly greater areas than the case was ten years ago. We expect this trend to continue”, Mr Ferdinand Hlobil concludes.